On March 19, 2019 the Federal Liberal Government tabled the 2019 Federal Budget, allowing the Liberal Government a bit of a platform heading into the federal election campaign. This is a budget that tries to keep everyone happy.

This Liberal budget focuses on key electoral voters: millennials, workers and seniors. Some of the focus of this budget is on hot topic issues such as National Pharmacare, pensions, reconciliation, skills development, affordable housing and further infrastructure development.

The 2019 Federal Budget proposes $22.8 billion in new spending over the next five years. GDP is projected to grow by 1.8% in 2019 and 1.6% in 2020, before increasing in subsequent years. The Federal debt-to-GDP ratio will be reduced annually over the entire fiscal horizon.

The Government collected higher than expected tax revenue over the last two fiscal years and expects that trend to continue as employment figures continue to rise. Instead of lowering the deficit and or paying down the debt the federal Liberal government continues to spend money. This will be a clear dividing line between the Liberals and Conservatives during the next Federal Election.

GENERAL BUDGET HIGHLIGHTS

Some highlights of today’s Federal Budget that may be of general interest:

- Creation of a First-Time Home Buyer Incentive

- $1.7 billion in funding over five years for a new Canada Training Benefit.

- Introduction of the first of three ‘Regulatory Roadmaps’ to create more user-friendly and simpler federal regulations

- A one-time transfer of $2.2. billion through the federal Gas Tax Fund to municipalities and First Nations and a $6 billion national plan for near-universal internet connectivity.

- A proposal to work with the provinces and stakeholders to create the Canadian Drug Agency.

- A dedicated $150 million infrastructure fund based on recommendations by the Just Transition Task Force for Canadian Coal Power Workers and Communities

- The next steps to implementing a National Pharmacare program

DETAILED BUDGET ITEMS THAT MAY BE IMPORTANT TO THE IBEW ARE AS FOLLOWS:

More information on the Federal Budget can be found online HERE

IBEW CANADA 2019 BUDGET BREAKDOWN

CHAPTER 1 – INVESTING IN THE MIDDLE CLASS

Rental Housing Construction Financing extended

To provide more affordable rental options for middle class Canadians, Budget 2019 proposes to provide an additional $10 billion over nine years in financing through the Rental Construction Financing Initiative, extending the program until 2027–28. With this increase, the program would support 42,500 new units across Canada, particularly in areas of low rental supply. On an accrual basis, this represents an investment of $829.5 million over 19 years, starting in 2019–20.

Part 2: A New Approach to Helping Middle Class Canadians Find and Keep Good Jobs

Improving Gender and Diversity Outcomes in Skills Programs

Budget 2019 provides $5.0 million over five years, starting in 2019–20, to Employment and Social Development Canada to develop a strategy and improve capacity to better measure, monitor and address gender disparity and promote access of under-represented groups across skills programming. This will build on work already underway to improve the quality and accessibility of labour market information, in partnership with Statistics Canada and the Labour Market Information Council.

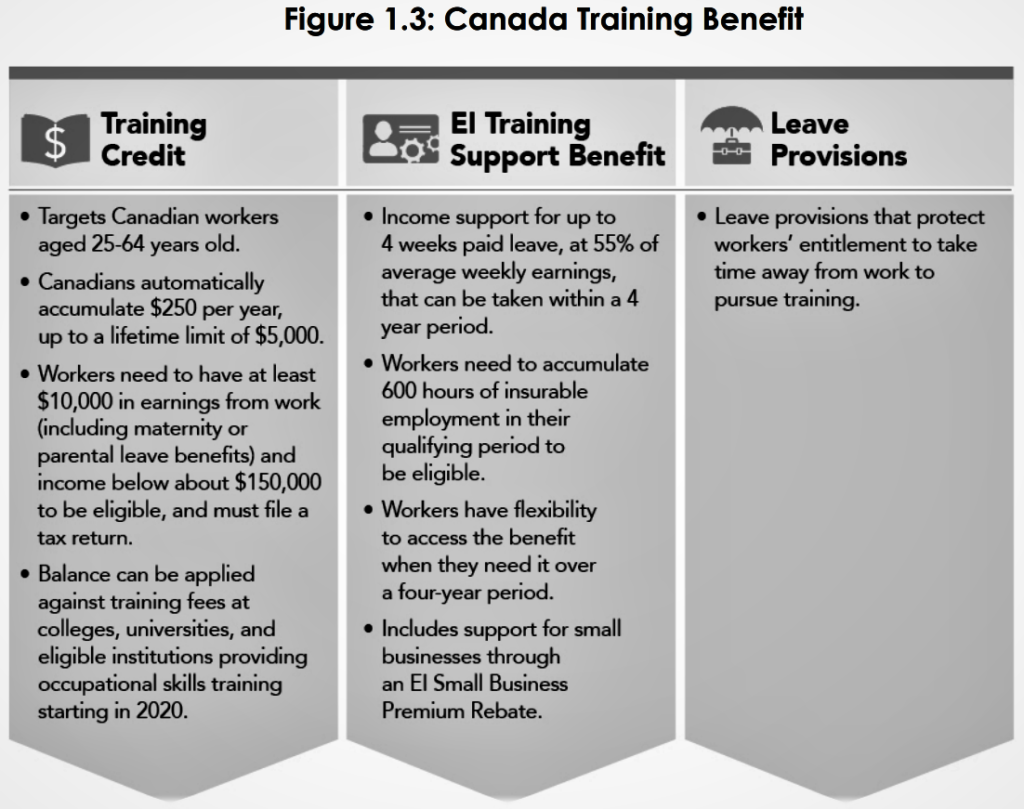

Canada Training Benefit

To help working Canadians get the skills they need to succeed in a changing world, Budget 2019 proposes to establish a new Canada Training Benefit—a personalized, portable training benefit to help people plan for and get the training they need. To deliver this new program, Budget 2019 proposes to invest more than $1.7 billion over five years, and $586.5 million per year ongoing.

What the Canada Training Benefit Means for Workers

After four years, workers will have four weeks for training, up to $1,000 to help pay for the training, money to help cover living expenses, and the security of knowing they’ll have a job to come back to when their training is done.

EI Training Support Benefit

This new benefit—expected to be launched in late 2020—would be available through the EI program and would provide up to four weeks of income support, every four years. This income support—paid at 55 per cent of a person’s average weekly earnings—would help workers cover their living expenses, providing support for ongoing payments such as mortgage payments, electricity bills, and general life costs, while on training and without their regular paycheque.

To introduce and deliver this new benefit, Budget 2019 proposes to invest $1.04 billion over five years, starting in 2019–20, and $321.5 million per year ongoing.

Making the EI Training Support Benefit Work for Employers

Budget 2019 proposes to introduce an EI Small Business Premium Rebate. Starting in 2020 any business that pays employer EI premiums equal to or less than $20,000 per year would be eligible for a rebate to offset the upward pressure on EI premiums resulting from the introduction of the new EI Training Support Benefit.

Enhancing Supports for Apprenticeship

To encourage more young people to consider training and work in the skilled trades, the Government proposes to provide Skills Canada—a national organization dedicated to encouraging young people to consider careers in the skilled trades and technology—with $40 million over four years, starting in 2020– 21, and $10 million per year ongoing.

To bolster these efforts, the Government also proposes to invest $6 million over two years, starting in 2019–20, to create a national campaign to promote the skilled trades as a first-choice career for young people. The campaign will work to change the perception around careers in the skilled trades, promoting their merits, including high demand, high wages, and continual professional development. In 2019, the Government will appoint co-chairs to begin work on this campaign, lead initial consultations, and explore partnerships to assist with promotion of the skilled trades.

Budget 2019 also proposes to develop a new strategy to support apprentices and those employed in the skilled trades. This Apprenticeship Strategy will ensure that existing supports and programs—including the Apprenticeship Incentive and Completion Grants—address the barriers to entry and progression for those who want to work in the skilled trades in the most effective way, and support employers who face challenges in hiring and retaining apprentices.

Modernizing the Youth Employment Strategy

Budget 2019 proposes to invest an additional $49.5 million over five years, starting in 2019–20, to launch a modernized Youth Employment Strategy informed by the recommendations of the Expert Panel on Youth Employment and extensive engagement with youth, service delivery organizations and other stakeholders.

CHAPTER 1 PART 3: Moving Forward on Implementing National Pharmacare

While the Government awaits the Advisory Council’s final report, the Government is prepared to take initial steps based on the Advisory Council’s consultations and interim report, released earlier this month. Budget 2019 announces the Government’s intention to work with its partners to move forward on three foundational elements of national pharmacare:

- The creation of the Canadian Drug Agency, a new national drug agency that will build on existing provincial and territorial successes and take a coordinated approach to assessing effectiveness and negotiating prescription drug prices on behalf of Canadians.

- In partnership with provinces, territories and stakeholders, part of the Agency’s work will be taking steps toward the development of a national formulary—a comprehensive, evidence-based list of prescribed drugs. This would provide the basis for a consistent approach to formulary listing and patient access across the country.

- A national strategy for high-cost drugs for rare diseases to help Canadians get better access to the effective treatments they need. Working with provinces, territories, and other partners, the Government will co-develop a plan to ensure that patients with rare diseases have better and more consistent coverage for their treatments, which are often life-saving.

Chapter 1 Part 4: A Secure Retirement

To allow low-income older Canadians to effectively take home more money while they work, Budget 2019 proposes to introduce legislation that would enhance the GIS earnings exemption beginning with the July 2020 to July 2021 benefit year. The enhancement would:

- Extend eligibility for the earnings exemption to self-employment income.

- Provide a full or partial exemption on up to $15,000 of annual employment and self-employment income for each GIS or Allowance recipient as well as their spouse, specifically by:

Canada Pension Plan

To ensure that all Canadian workers receive the full value of the benefits to which they contributed, the Government proposes to introduce legislative amendments to proactively enroll Canada Pension Plan contributors who are age 70 or older in 2020 but have not yet applied to receive their retirement benefit.

Protecting Canadians Pensions

Budget 2019 proposes new measures that will make insolvency proceedings fairer, more transparent and more accessible for pensioners and workers. This will be accomplished in part by requiring everyone involved to act in good faith, and by giving courts greater ability to review payments made to executives in the lead up to insolvency.

CHAPTER 2 BUILDING A BETTER CANADA

Part 1: Building Strong Communities

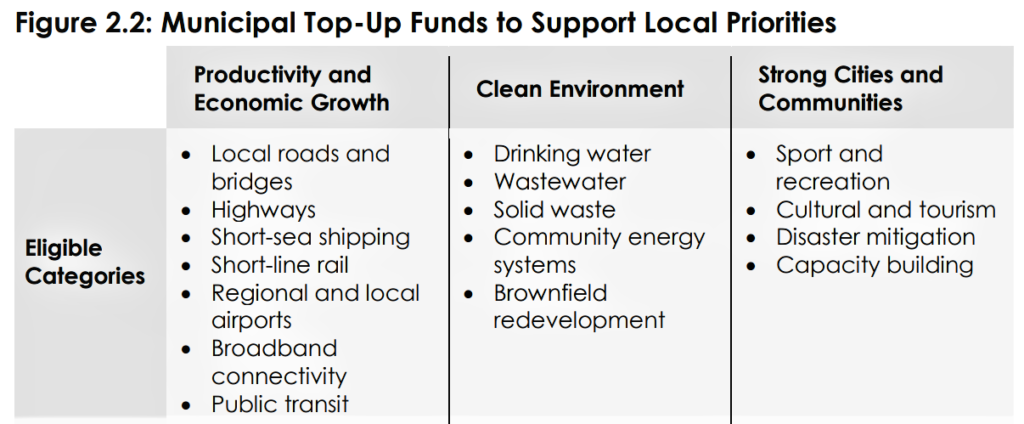

Budget 2019 proposes a one-time transfer of $2.2 billion through the federal Gas Tax Fund to address short-term priorities in municipalities and First Nation communities. This will double the Government’s commitment to municipalities in 2018–19 and will provide much needed infrastructure funds for communities of all sizes, all across the country.

Part 2: Affordable Electricity Bills and a Clean Economy

Investing in the Future of Transportation

Canada has set a target to sell 100 per cent zero-emission vehicles by 2040, with sales goals of 10 per cent by 2025 and 30 per cent by 2030 along the way.

Vehicle Charging and Refueling Stations:

To expand the network of zero-emission vehicle charging and refueling stations, Budget 2019 proposes to build on previous investments by providing Natural Resources Canada with $130 million over five years, starting in 2019–20, to deploy new recharging and refueling stations in workplaces, public parking spots, commercial and multi-unit residential buildings, and remote locations.

This is an excellent opportunity for the IBEW and our Contractors to install and grow the electric vehicle charging network across Canada. Working with NETCO and ensuring more of our Local Union Training Centres have the EVITP training program will ensure we have a trained workforce at the ready.

Reducing Energy Costs Through Greater Energy Efficiency

Budget 2019 proposes to invest $1.01 billion in 2018–19 to increase energy efficiency in residential, commercial and multi-unit buildings. These investments will be delivered by the Federation of Canadian Municipalities (FCM) through the Green Municipal Fund.

More Connectivity = More Affordable Electricity

In Canada, the provinces and territories—rather than the federal government— are responsible for the generation, transmission, distribution and sale of electricity within their boundaries. First Ministers agreed in December 2018 to develop a framework for a clean electric future of reliable and affordable electricity, including by considering interprovincial clean energy corridors. Partners also agreed on the importance of encouraging communities to move away from using diesel to generate power in remote communities and to increase industrial electrification.

The Canada Infrastructure Bank (CIB) has identified clean hydroelectricity and electrical connectivity infrastructure as an area it will look to support in its upcoming workplans. The CIB is well positioned to work with jurisdictions, including northern communities, to plan and finance projects that improve access within Canada to affordable, reliable and clean electricity in the most effective way.

This includes projects that improve interconnections between provincial electricity grids. The CIB can help jurisdictions to assess supply and demand dynamics, and to develop business cases for promising projects. It can also co-invest in projects in order to attract capital from and transfer risks to the private sector—helping to expand the reach of public infrastructure dollars. The CIB has been allocated $5 billion for investments in green infrastructure, which could include electricity projects such as interties between provinces and territories.

The Government also recognizes that small jurisdictions face unique constraints. Through improvements to the Investing in Canada Infrastructure Program, the Government will support planning efforts by jurisdictions to advance clean energy projects and other infrastructure priorities in small communities and the territories.

A Just Transition for Canadian Coal Power Workers and Communities

In response to the Task Force’s recommendations, the Government intends to take the following actions:

- Create worker transition centres that will offer skills development initiatives and economic and community diversification activities in western and eastern Canada. These efforts are being supported by a federal investment of $35 million over five years, funded through Budget 2018, for Western Economic Diversification Canada and the Atlantic Canada Opportunities Agency.

- Work with those affected to explore new ways to protect wages and pensions, recognizing the uncertainty that this transition represents for workers in the sector.

- Create a dedicated $150 million infrastructure fund, starting in 2020–21, to support priority projects and economic diversification in impacted communities. This Fund will be administered by Western Economic Diversification Canada and the Atlantic Canada Opportunities Agency.

Access to High Speed Internet for All Canadians

To help every Canadian gain access to high-speed internet at minimum speeds of 50/10 Mbps, Budget 2019 proposes to invest up to $1.7 billion in new targeted initiatives that will support universal high-speed internet in rural, remote and northern communities.

Chapter 4 – Delivering Real Change

Advancing Gender Equality

To further support the Department in its strengthened mandate and continue to advance gender equality in Canada, Budget 2019 proposes a historic investment: $160 million over 5 years, starting in 2019–20. By 2023–24, the Women’s Program will total $100 million annually. This funding will enable further community action to tackle systemic barriers impeding women’s progress, while recognizing and addressing the diverse experiences of gender and inequality across the country.

Moving Toward the Next Generation Pay System for the Federal Public Service (Phoenix)

Working cooperatively with experts, federal public sector unions, employees, pay specialists and technology providers, the Treasury Board Secretariat (TBS) launched a process to review lessons learned, and identify options for a next generation pay solution.

TBS has been able to identify options with the potential to successfully replace the Phoenix pay system. As a next step, the Government will work with suppliers and stakeholders to develop the best options, including pilot projects that will allow for further testing with select departments and agencies, while assessing the ability of suppliers to deliver.