On April 19, 2021, about two years since our last Federal Budget, the Liberal Government tabled the 2021 Federal Budget, their first since the pandemic began. Budget 2021, called “A Recovery Plan for Jobs, Growth, and Resilience” which proposes some progressive policies that attempts to address some of the cracks in our safety nets that the pandemic has exposed.

The COVID-19 recession is the steepest and fastest economic contraction since the Great Depression. It has disproportionately affected low-wage workers, young people, women, and racialized Canadians. For businesses, it has been a two-speed recession, with some finding ways to prosper and grow, but many businesses—especially small businesses—fighting to survive.

The Federal Government dubs Budget 2021 as a plan for a green recovery that fights climate change, helps more than 200,000 Canadians make their homes greener, builds a net-zero economy by investing in world-leading technologies that make industry cleaner, helps Canada reach its goal of conserving 25 per cent of our lands and oceans by 2025, and states it will create good middle-class jobs in the green economy along the way.

This budget clearly targets immediate initiatives to provide training to workers who have lost their jobs, continue social supports, help employers and sectors who have been hardest hit by the pandemic with a focus on the most vulnerable workers.

GENERAL BUDGET HIGHLIGHTS

Some highlights of today’s Federal Budget that may be of general interest:

- Canada Emergency Wage Subsidy will be extended until September 25th, 2021

- Federal Minimum wage of $15 per hour, rising with inflation

- National Child Care program which will include investments up to $30 billion over the next 5 years, and $8.3 billion ongoing for Early Learning and Child Care with a goal of creating $10 per day Child Care

- $470 million over three years to establish a new Apprenticeship Service, which the Government claims will help 55,000 first year apprentices in construction and manufacturing Red Seal trades connect with opportunities at small and medium-sized employers.

- $491.2 million over six years to VIA Rail Canada for infrastructure investments that would support the overall success of the high frequency rail project.

- $500 million over two years to the regional development agencies for community infrastructure.

DETAILED BUDGET ITEMS THAT MAY BE IMPORTANT TO THE IBEW CAN BE FOUND ON THE FOLLOWING PAGES

More information on the Federal Budget can be found online HERE

IBEW CANADA 2021 BUDGET BREAKDOWN

Chapter 2 – Seeing Canadians and Businesses Through to Recovery

2.1 Protecting Jobs and Supporting Businesses

- Budget 2021 proposes to extend the wage subsidy until September 25, 2021. It also proposes to gradually decrease the subsidy rate, beginning July 4, 2021.

- The government will seek the legislative authority to have the ability to further extend the wage subsidy program through regulations until November 20, 2021, should the economic and public health situation require it beyond September 2021.

- Budget 2021 proposes to require that any publicly listed corporation receiving the wage subsidy and found to be paying its top executives more in 2021 than in 2019 will need to repay the equivalent in wage subsidy amounts received for any qualifying period starting after June 5, 2021 and until the end of the wage subsidy program.

2.2 Supporting Affected Workers – Employment Insurance

- EI Waiting Period – Last Fall, the government temporarily waived the one-week waiting period for Employment Insurance Claims. In response to ongoing restrictions in many parts of the country this winter, the government announced that the waiting period would be waived for EI beneficiaries who establish a new claim between January 31, 2021, and September 25, 2021.

- Canada Recovery Benefit (CRB) – The Budget proposes to provide up to 12 additional weeks of Canada Recovery Benefit to a maximum of 50 weeks.

- The first four of these additional 12 weeks will be paid at $500 per week.

- As the economy reopens over the coming months, the government intends that the remaining 8 weeks of this extension will be paid at a lower amount of $300 per week claimed.

- All new Canada Recovery Benefit claimants after July 17, 2021 would also receive the $300 per week benefit, available up until September 25, 2021.

- Budget 2021 proposes $3.9 billion over three years, starting in 2021-22, for a suite of legislative changes to make EI more accessible and simple for Canadians over the coming year while the job market begins to improve. The changes would:

- Maintain uniform access to EI benefits across all regions, including through a 420-hour entrance requirement for regular and special benefits, with a 14-week minimum entitlement for regular benefits, and a new common earnings threshold for fishing benefits.

- Support multiple job holders and those who switch jobs to improve their situation as the recovery firms up, by ensuring that all insurable hours and employment count towards a claimant’s eligibility, as long as the last job separation is found to be valid.

- Allow claimants to start receiving EI benefits sooner by simplifying rules around the treatment of severance, vacation pay, and other monies paid on separation. *This is an item that IVP Reid and IBEW Canada strongly advocated for with the Government including direct conversations with the Minister of Employment, Workforce Development and Disability Inclusion.

- Extend the temporary enhancements to the Work-Sharing program such as the possibility to establish longer work-sharing agreements and a streamlined application process, which will continue to help employers and workers avoid layoffs.

- The Budget also announced forthcoming consultations on future, long-term reforms to EI. To support this effort, the government proposes to provide $5 million over two years, starting in 2021-22, to Employment and Social Development Canada to conduct targeted consultations with Canadians, employers, and other stakeholders from across the country. Consultations will examine systemic gaps exposed by COVID-19, such as the need for income support for self-employed and gig workers; how best to support Canadians through different life events such as adoption; and how to provide more consistent and reliable benefits to workers in seasonal industries. Any permanent changes to further improve access to EI will be made following these consultations and once the recovery is fully underway.

- IBEW Canada will be involved in these consultations ensuring that our members have a voice in any potential EI Reforms.

Extending Employment Insurance Sickness Benefits

The Budget proposes funding of $3.0 billion over five years, starting in 2021-22, and $966.9 million per year ongoing to enhance sickness benefits from 15 to 26 weeks.

Budget 2021 also proposes to make amendments to the Employment Insurance Act, as well as corresponding changes to the Canada Labour Code to ensure that workers in federally regulated industries have the job protection they need while receiving EI sickness benefits.

Part II – Creating Jobs and Growth

National Child Care

- Up to $27.2 billion over five years, starting in 2021-22 will bring the federal government to a 50/50 share of childcare costs with provincial and territorial governments, as part of initial 5-year agreements.

The aforementioned federal funding would allow for:

- A 50 per cent reduction in average fees for regulated early learning and childcare in all provinces outside of Quebec, to be delivered before or by the end of 2022.

- An average of $10 a day by 2025-26 for all regulated childcare spaces in Canada.

- Ongoing annual growth in quality affordable childcare spaces across the country, building on the approximately 40,000 new spaces already created through previous federal investments.

- Expanding before- and after-school care to provide more flexibility for working parents.

Unfortunately, too many members still face the challenge of access to childcare for their work hours. Many IBEW members do not work the 9am-5pm shift, and therefore childcare spaces need to be available for workers who work shifts other than the 9-5. IBEW Canada will continue our advocacy in this area, ensuring that all workers have access to affordable childcare, not just those workers who work 9-5.

3.3 Investing in Skills, Training, and Trades

- Budget 2021 proposes to provide $470 million over three years, beginning in 2021-22, to Employment and Social Development Canada to establish a new Apprenticeship Service. The Apprenticeship Service would help 55,000 first year apprentices in construction and manufacturing Red Seal trades connect with opportunities at small and medium-sized employers.

- Employers would be eligible to receive up to $5,000 for all first-year apprenticeship opportunities to pay for upfront costs such as salaries and training.

- In addition, to boost diversity in the construction and manufacturing Red Seal trades, this incentive will be doubled to $10,000 for employers who hire those underrepresented, including women, racialized Canadians, and persons with disabilities.

IBEW Canada has had several discussions with the Minister and key staff on this initiative and we will continue to meet on this matter and share our concerns and suggestions to ensure this does not have a negative impact on our members, contractors, or the industry.

Ensuring Communities Recover Through Skills Training and Workforce Planning

- Budget 2021 proposes to provide $55 million over three years, starting in 2021-22, to Employment and Social Development Canada for a Community Workforce Development Program. The program will support communities to develop local plans that identify high

potential growth organizations and connect these employers with training providers to develop and deliver training and work placements to upskill and reskill jobseekers to fill jobs in demand.

- Budget 2021 proposes to provide $250 million over three years, starting in 2021-22, to Innovation, Science and Economic Development Canada for an initiative to scale-up proven industry-led, third-party delivered approaches to upskill and redeploy workers to meet the needs of growing industries.

Establishing a $15 Federal Minimum Wage

- The Government of Canada is announcing its intention to introduce legislation that will establish a federal minimum wage of $15 per hour, rising with inflation, with provisions to ensure that where provincial or territorial minimum wages are higher, that wage will prevail. This will directly benefit workers in the federally regulated private sector.

Better Labour Protection for Gig Workers

- Budget 2021 reiterates the government’s commitment to making legislative changes to improve labour protection for gig workers, including those who work through digital platforms but there is no official announcement.

- Following the conclusion of consultations recently launched on this topic by the Minister of Labour, which our office has shared with Local Unions across the country, the government will bring forward amendments to the Canada Labour Code to make these new, modernized protections a reality.

We will continue to monitor the status and proposed changes to the Canada Labour Code regarding the above subject.

Removing Barriers to Internal Trade

One of the priorities identified over the last few months has been barriers to internal trade within Canada. IBEW Canada has participated in talks specifically around the second bullet below. As the consultation process continues, our office will be involved and providing our input on issues that directly impact our members.

- Budget 2021 proposes to allocate $21 million over three years, starting in 2021-22, to:

- Work with provincial and territorial partners to enhance the capacity of the Internal Trade Secretariat that supports the Canadian Free Trade Agreement in order to accelerate the reduction of trade barriers within Canada.

- Advance work with willing partners towards creating a repository of open and accessible pan-Canadian internal trade data to identify barriers, including licensing and professional certification requirements, so that we can work together to reduce them.

- Pursue internal trade objectives through new or renewed discretionary federal transfers to provinces and territories.

BROADBAND

The pandemic has exposed the necessity for Canadians to not only be connected to a stable electricity source, but steady reliable internet.

- Budget 2021 proposes to provide an additional $1 billion over six years, starting in 2021-22, to the Universal Broadband Fund to support a more rapid rollout of broadband projects in collaboration with provinces and territories and other partners.

- This is working to reach Canada’s goal of 98 per cent of the country having high-speed broadband by 2026 and 100 per cent by 2030.

5.1 Growing Our Net-zero Economy

- Budget 2021 proposes to provide $5 billion over seven years (cash basis), starting in 2021-22, to the Net Zero Accelerator. This funding would allow the government to provide up to $8 billion of support for projects that will help reduce domestic greenhouse gas emissions across the Canadian economy.

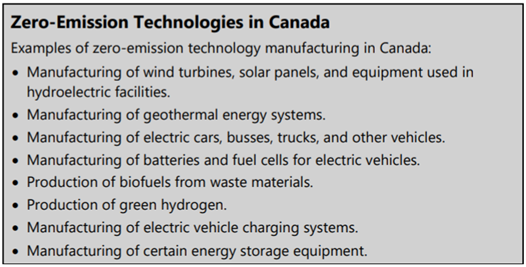

- Budget 2021 proposes to reduce—by 50 per cent—the general corporate and small business income tax rates for businesses that manufacture zero emission technologies. The reductions would go into effect on January 1, 2022, and would be gradually phased out starting January 1, 2029 and eliminated by January 1, 2032.

Charging and Fueling Zero-emission Vehicles

- Since 2015, there has been a rapid increase in the number of Canadians who own zero-emission vehicles (ZEVs). Federal and Provincial Governments have also ramped up investments in EV Charging stations across the country.

- The 2021 Budget proposes to provide $56.1 million over five years, starting in 2021-22, with $16.3 million in remaining amortization and $13 million per year ongoing, to establish a set of codes and standards for retail ZEV charging and fueling stations.

- This would include accreditation and inspection frameworks needed to ensure the standards are adhered to at Canada’s vast network of charging and refueling stations.

- This measure would provide regulatory certainty to providers of charging services and facilitate the development of the charging network. It would also give more Canadians confidence to purchase and drive ZEVs.

Federal Clean Electricity Fund

- To support the Government of Canada’s commitment to power federal buildings with 100 per cent clean electricity by 2022, Budget 2021 proposes to provide $14.9 million over 4 years, starting in 2022-23, with $77.9 million in future years, to Public Services and Procurement Canada for a Federal Clean Electricity Fund to purchase renewable energy certificates for all federal government buildings

Investing in Clean Energy in Northern and Indigenous Communities

- The Governments Budget proposes to invest $40.4 million over three years, starting in 2021-22, to support feasibility and planning of hydroelectricity and grid interconnection projects in the North. This funding could advance projects, such as the Atlin Hydro Expansion Project in Yukon and the Kivalliq Hydro Fibre Link Project in Nunavut. Projects will provide clean power to northern communities and help reduce emissions from mining projects.

- Budget 2021 also proposes to invest $36 million over three years, starting in 2021-22, through the Strategic Partnerships Initiative, to build capacity for local, economically-sustainable clean energy projects in First Nations, Inuit, and Métis communities and support economic development opportunities.

Home Energy Retrofits

- Budget 2021 proposes to provide $4.4 billion on a cash basis ($778.7 million on an accrual basis over five years, starting in 2021-22, with $414.1 million in future years) to the Canada Mortgage

and Housing Corporation (CMHC) to help homeowners complete deep home retrofits through interest-free loans worth up to $40,000.

National Infrastructure Assessment

Twenty-first century energy systems, public buildings, broadband networks, roadways, public transit, and natural spaces all contribute to our long-term economic productivity and prosperity. But smart, resilient public infrastructure projects also require careful planning. To support Canada’s long-term infrastructure planning:

- This year’s Budget proposes to provide $22.6 million over four years, starting in 2021-22, to Infrastructure Canada to conduct Canada’s first ever National Infrastructure Assessment. The assessment would help identify needs and priorities for Canada’s built environment.

Next Step Towards High Frequency Rail in the Toronto-Quebec City Corridor

- To continue this work, Budget 2021 proposes to provide $4.4 million in 2021- 22 to Transport Canada and VIA Rail Canada to support their work with the Joint Project Office in order to advance due diligence and to de-risk the project.

- In addition, Budget 2021 proposes to provide $491.2 million over six years, starting in 2021-22, to VIA Rail Canada for infrastructure investments that would support the overall success of the high frequency rail project.

Enhancing the Temporary Foreign Worker Program

Canada’s Temporary Foreign Worker (TFW) Program has had no shortage of issues, especially in our Construction sector. IBEW has long advocated for better enforcement and spot inspections on the worksites of employers who have brought on TFW’s. We are pleased with the proposed ramp up of inspections around working conditions and wages announced below.

- $54.9 million over three years, starting in 2021-22, to Employment and Social Development Canada and Immigration, Refugees and Citizenship Canada, to increase inspections of employers and ensure temporary foreign workers have appropriate working conditions and wages.

- $6.3 million over three years, starting in 2021-22, to Immigration, Refugees and Citizenship Canada, to support faster processing and improved service delivery of open work permits for vulnerable workers, which helps migrant workers in situations of abuse find a new job. The government has zero tolerance for any abuse of workers.

Part III A Resilient and Inclusive Recovery

Addressing the Opioid Crisis and Problematic Substance Use

The COVID-19 pandemic has compounded the ongoing opioid overdose crisis in Canada. Isolation, stress, toxic supply, and reduced access to services have contributed to the epidemic. Canada suffered a 74 per cent increase in opioid-related deaths over the course of the first six months of the pandemic. One of the hardest hit sectors continues to be in Construction.

- Budget 2021 proposes to provide an additional $116 million over two years, starting in 2021-22, for the Substance Use and Addictions Program to support a range of innovative approaches to harm reduction, treatment, and prevention at the community level.

Indigenous Infrastructure

- Budget 2021 proposes distinctions-based investments of $6.0 billion over five years, starting in 2021-22, with $388.9 million ongoing, to support infrastructure in Indigenous communities, including:

- $4.3 billion over four years, starting in 2021-22, for the Indigenous Community Infrastructure Fund, a distinctions-based fund to support immediate demands, as prioritized by Indigenous partners, with shovel ready infrastructure projects in First Nations, including with modern treaty and self-governing First Nations, Inuit, and Métis Nation communities.

- $1.7 billion over five years, starting in 2021-22, with $388.9 million ongoing, to cover the operations and maintenance costs of community infrastructure in First Nations communities on reserve.